7 Must-Know Trends in Single-Family Rentals for 2024

2023 was another rocky year for the housing market. Rental market trends were driven largely by inflation, shifting demographics, scarcity in housing, and a rise in the cost of just about everything.

Those trends, however, didn’t necessarily spell bad news for single-family rentals, and as we leave 2023 behind, single-families are well-positioned to remain strong in 2024.

Couples and families looking for a house of their own have had to defer their dream of homeownership. And while renters, particularly young professionals, have begun a slow return to more urban areas, where multifamily rentals reign, single-family housing is still in high demand.

But let’s get a little more specific on the single-family rental trends you can expect to see in 2024. In this blog post, we will explore seven of them, focusing on the intersection of single-family property management and the evolving rental landscape.

1. Continued Demand for Single-Family Rentals

One of the most prominent trends in the single-family rental market is the continued increase in demand.

Buildium’s 2023 Property Management Industry Report notes that, for the second year in a row, the size of households has grown as couples with children and multi-generational families become a larger part of the rental demographic.

At the same time, millennials are less likely to jump into homeownership than their parents and grandparents. As they grow their families, single-family rentals remain a popular choice, and should continue to be in 2024, as they look for the space, schools, and other amenities the suburbs offer.

In 2024, the demand for single-family rentals should persist, as the industry report notes, “As households grow slightly larger—and as couples and families continue to be priced out of the housing market—we expect to see demand remain strong for single-family rentals.”

2. New Single-Family Home Construction

According to NerdWallet, builders across the U.S. applied for more single-family permits than they have since May 2022. With more housing completed by the middle and end of 2024, the housing crunch should ease a little.

New homes—if they are slated for rentals—could lead to more competition in the rental market. But home prices for buyers will most likely remain high as interest rates ease only a little and potential buyers remain scarce. That still leaves Americans to look for rental homes until prices drop lower.

3. Tech-Driven Property Management

The integration of technology into property management is a trend that will only intensify in 2024.

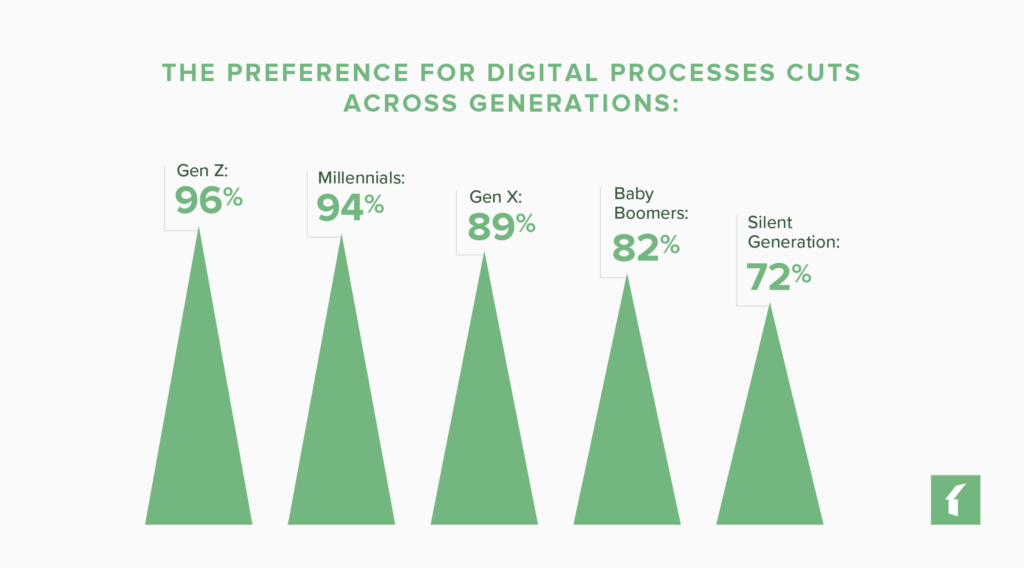

According to the Industry Report, 24% of rental owners look for a property manager who uses online tools to digitize rental processes. Meanwhile, 90% of renters are interested in completing at least some (if not all) rental processes online.

This preference for digital processes cuts across generations:

Property managers and landlords will rely increasingly on property management software, smart home devices, and automation to streamline operations, enhance security, and deliver better services to their tenants. This tech-driven approach will improve tenant experiences and make property management more efficient.

4. Challenges Finding Quality Tenants

Although they won’t come down drastically, the lower mortgage rates will help some renters transition to homeownership. That, coupled with the availability of more single-family homes, could reduce the number of prospective tenants for single-family homes a little.

Property managers have a twofold approach to tackling this problem.

To find good tenants, they’re turning to tenant screening software with predictive and AI tools to find the best matches for the properties they manage.

As one property manager from Arkansas told us, “The biggest issue is finding quality tenants. Having a great screening process is invaluable. The rental market is such that we have no end of applicants, but we spend a significant amount of our time screening them. Our hope is to streamline and fine-tune this process to reach quality tenants and make them want to stay long term.”

To reduce turnover and retain good tenants, they are stepping up their tenant-experience game by offering better amenities and capping rent increases.

According to the Industry Report, “When it comes to the amenities within their rental unit, renters are looking for a space with all the comforts of home, from air conditioning and a washer and dryer to the option to own a pet—features that have drawn a third of the renters we surveyed to single-family rentals.”

Meanwhile, amenities such as pools, fitness centers, and community gardens make a rental attractive, but are seen as nice-to-haves, rather than must-haves.

5. Regulatory Changes

The end of every calendar year is a good time for owners and property managers to look ahead to new laws and regulations taking effect the following year. Depending on where you manage or own property, there will be some regulatory changes in 2024.

Here are two examples:

- Starting in April, California landlords must state a specific reason for ending a lease early and pay relocation expenses for reasons that are not the fault of the tenant. While single-family rental homes are largely exempt from this law, a mandatory notice must be provided in order for the exemption to apply.

- Single-family rental owners in Denver should have already obtained a license to operate by January 1, 2024, for which they will have to pay a $50 licensing fee and provide copies of leases for their units.

6. Continued Popularity of Single-Family Rental REITs

In 2022, Motley Fool reported on the shift from multifamily to single-family rental real estate investment trusts (REITs). In 2023, as Americans chose to delay homeownership and opted to rent, single family-rental REITs outperformed other REITs.

REITs are companies that own and run rental properties purely for investment purposes. They pool money from small investors to buy and operate properties, and, in turn, individual investors have the opportunity to get into real estate investment without a major financial commitment.

If the housing market—and the economy in general—continue on the current trajectory, single-family REITs should remain popular investment vehicles.

7. The Mandatory Affordable Housing Program

The Biden administration’s budget request for the Department of Housing and Urban development includes a number of provisions to increase the availability of affordable homes, prevent evictions, and provide rent relief.

One such program is Project-Based Rent Assistance for extremely low-income households. The program includes $7.5 billion in funding for contracts with owners to provide affordable housing.

All of the administration’s programs aim to ease the high cost of housing, while providing incentive for developers and owners to provide more affordable housing.

In 2024, owners and property managers may be able to attract and keep tenants with lower incomes through these programs.

The single-family rental market is poised for continued growth and innovation in 2024. With the rise in demand, evolving tenant preferences, and the integration of technology, the industry is adapting to meet the changing landscape of single-family property management.

Investors, landlords, and property managers who stay on top of these upcoming trends will be well-positioned to succeed in the dynamic world of single-family rentals. If you’re a property manager looking for a way to integrate technology into your business plans for 2024, take a look at Propertyware and sign up for a free demo.